- RETIREMENT ANNOUNCEMENT

- HOME PAGE

- "MYCHART" the new patient portal

- BELMONT MEDICAL ASSOCIATES

- MOUNT AUBURN HOSPITAL

- EMERGENCIES

- PRACTICE PHILOSOPHY

- MY RESUME

- TELEMEDICINE CONSULTATION

- CONTACT ME

- LAB RESULTS

- ePRESCRIPTIONS

- eREFERRALS

- RECORD RELEASE

- MEDICAL SCRIBE

- PHYSICIAN ASSISTANT (PA)

- Medicare Annual Wellness Visit

- Case management/Social work

- Quality Care Measures

- Emergency closing notice

- FEEDBACK

- Talking to your doctor

- Choosing..... and losing a doctor

- INDEX A - Z

- ALLERGIC REACTIONS

- Alternative Medicine

- Alzheimer's Disease

- Bladder Problems

- Blood disorders

- Cancer Concerns

- GENETIC TESTING FOR HEREDITARY CANCER

- Chronic Obstructive Pulmonary Disease

- Controversial Concerns

- CPR : Learn and save a life

- CRP : Inflammatory marker

- Diabetes Management

- Dizziness, Vertigo,Tinnitus and Hearing Loss

- EXERCISE

- FEMALE HEALTH

-

GASTROINTESTINAL topics

- Appendicitis

- BRAT diet

- Celiac Disease or Sprue

- Crohn's Disease

- Gastroenterologists for Colon Cancer Screening

- Colonoscopy PREP

- Constipation

- Gluten sensitivity, but not celiac disease

- Heartburn and GERD

- Hemorrhoids and Anal fissure

- Irritable Bowel Syndrome (IBS)

- Inflammatory Bowel Disease

- NASH : Non Alcoholic Steato Hepatitis

- FEET PROBLEMS

- HEART RELATED topics

-

INFECTIOUS DISEASES

- Antibiotic Resistance

- Cat bites >

- Clostridia difficile infection - the "antibiotic associated germ"

- CORONA VIRUS

- Dengue Fever and Chikungunya Fever

- Food borne illnesses

- Shingles Vaccine

- Hepatitis B

- Hepatitis C

- Herpes

- Influenza

- Helicobacter pylori - the "ulcer germ"

- HIV Screening

- Lyme and other tick borne diseases

- Measles

- Meningitis

- MRSA (Staph infection)

- Norovirus

- Sexually Transmitted Diseases

- Shingles (Herpes Zoster)

- Sinusitis

- West Nile Virus

- Whooping Cough (Pertussis)

- Zika virus and pregnancy

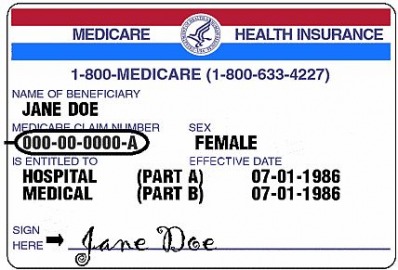

- INSURANCE related topics

- KIDNEY STONES

- LEG CRAMPS

- LIBRARY for patients

- LIFE DECISIONS

- MALE HEALTH

- Medication/Drug side effects

- MEDICAL MARIJUANA

- MENTAL HEALTH

- Miscellaneous Articles

-

NUTRITION - EXERCISE - WEIGHT

- Cholesterol : New guidelines for treatment

- Advice to lower your cholesterol

- Cholesterol : Control

- Cholesterol : Raising your HDL Level

- Exercise

- Food : Making Smart Choices

- Food : Making Poor Choices

- Food : Grape Fruit and Drug Interaction

- Food : Vitamins, Minerals and Supplements

- Omega 3 fatty acids

- Vitamin B12 deficiency

- Vitamin D

- Weight Loss

- ORTHOPEDICS

- PAIN

- PATIENTS' RIGHTS

- SKIN

- SLEEP

- SMOKING

- STROKE

- THYROID

- SUBSTANCE ABUSE

- Travel and Vaccination

- TREMOR

- Warfarin Anticoagulation

- OTHER STUFF FOLLOWS

- Fact or Opinion?

- Hippocratic Oath

- FREE ADVICE.......for what its worth!

- LAUGHTER.....is the best medicine

- Physicians Pet Peeves

- PHOTO ALBUM - its not all work!

- Cape Town, South Africa

- Tribute page

- The 100 Club

- Free Wi-Fi

Medicare Related Issues

Meeting Medicare deadlines is crucial

By Lynn Asinof | GLOBE CORRESPONDENT APRIL 21, 2013

Medicare policy and politics are making big headlines these days. But as political leaders debate the long-term future of the government health care program, people still need to make coverage decisions as they become eligible for benefits.

Any of these decisions could involve navigating a labyrinth of choices and deadlines. Perhaps you take a drug that costs $2,000 a month. Or your employer is providing health care benefits even though you’ve already turned 65. Or maybe you plan to head south for several months each winter.

Such variables make a big difference in how your coverage works. And there is no single right answer.

“It is very complex,” said Peggy McDonough, a regional director of the Massachusetts assistance program known as Serving Health Insurance Needs of Elders, also know as SHINE.

The most important deadline is your 65th birthday, which is when most folks qualify for Medicare. You can sign up online at www.medicare.gov or at a Social Security office starting three months before your 65th birthday. The initial sign-up period runs seven months.

What do you sign up for? That depends.

Medicare Part A covers hospitalization. There’s no reason to delay here, since there’s no cost for this coverage. Miss the initial sign-up period, and you’ll have to wait until the next general enrollment period which runs January through March. Your coverage then won’t begin until July, so if you get ill before then, you’ll be paying hospital bills by yourself.

Different rules govern Part B, which covers doctors’ visits, medical tests, and outpatient procedures. There are monthly premiums — currently ranging from $104.90 to $335.70 depending on income — so don’t sign up for Part B until you actually need it.

People still covered by employee health plans, for example, effectively get an extension. Ditto for people covered by a spouse’s employee benefits — except for same-sex spouses since the federal government doesn’t recognize those marriages. Once employer benefits end, people have eight months to enroll before triggering penalties.

The penalty for missing these Part B deadlines can be painful — a permanent premium increase of 10 percent for every 12 months missed. “Go five years without Part B, and you’ll have to pay a 50 percent penalty on your premiums when you do sign up,” said SHINE’s McDonough.

Too often people mistakenly believe that their retiree health benefits from a former employer will get them a Part B deadline extension. They don’t. Neither will COBRA coverage.

Part D, which provides prescription drug coverage, comes with its own set of deadlines and penalties. There’s no need to sign up if you have what’s called “creditable” coverage — a drug plan at least as good as what Medicare offers. If your plan doesn’t meet that standard — and your provider can tell you if it does — you need to sign up during the initial enrollment period when you turn 65. Once creditable drug coverage ends, however, you have only 60 days to sign up.

There’s a stiff premium penalty for missing these deadlines — a 1 percent increase for every month you’re late. That can add up fast. For example, someone who failed to sign up for Part D when it was first offered in 2006 would now face a penalty of over 80 percent.

Choosing the right drug coverage means not only looking at premiums, but also checking to see if your drugs are covered. The Medicare website can help match your prescriptions to available plans.

In Massachusetts, the state provides help through Prescription Advantage, an income-based program that helps with drug copayments. One example: Last summer, a woman needing a cancer drug costing $6,000 a month had hit her initial Medicare drug coverage limit but she was not yet eligible for catastrophic coverage. But since she qualified for the state program, her copay was $7.69, according to McDonough.

Plans offered by Blue Cross Blue Shield, Tufts, Harvard Pilgrim, and others provide an alternative to original Medicare. Known as Medicare Advantage, the plans combine Parts A, B, and usually D in an HMO-like package along with additional benefits that might include vision care and health club reimbursement.

Prices, out-of-pocket costs, and rules governing how you get service can vary considerably, so compare plan details. If you’re going to be in Florida six months of the year, however, Medicare Advantage plans won’t work since they only cover emergency and urgent care when you’re outside your plan area.

Finally, those who opt for original Medicare shouldn’t be without a supplemental policy to cover all the things that Medicare doesn’t, such as copayments and deductibles. Massachusetts residents have an advantage here. The state doesn’t let insurers screen for preexisting conditions for supplemental policies. Moreover, Massachusetts residents can sign up for supplemental policies at any time, thanks to continuous open enrollment.

By Lynn Asinof | GLOBE CORRESPONDENT APRIL 21, 2013

Medicare policy and politics are making big headlines these days. But as political leaders debate the long-term future of the government health care program, people still need to make coverage decisions as they become eligible for benefits.

Any of these decisions could involve navigating a labyrinth of choices and deadlines. Perhaps you take a drug that costs $2,000 a month. Or your employer is providing health care benefits even though you’ve already turned 65. Or maybe you plan to head south for several months each winter.

Such variables make a big difference in how your coverage works. And there is no single right answer.

“It is very complex,” said Peggy McDonough, a regional director of the Massachusetts assistance program known as Serving Health Insurance Needs of Elders, also know as SHINE.

The most important deadline is your 65th birthday, which is when most folks qualify for Medicare. You can sign up online at www.medicare.gov or at a Social Security office starting three months before your 65th birthday. The initial sign-up period runs seven months.

What do you sign up for? That depends.

Medicare Part A covers hospitalization. There’s no reason to delay here, since there’s no cost for this coverage. Miss the initial sign-up period, and you’ll have to wait until the next general enrollment period which runs January through March. Your coverage then won’t begin until July, so if you get ill before then, you’ll be paying hospital bills by yourself.

Different rules govern Part B, which covers doctors’ visits, medical tests, and outpatient procedures. There are monthly premiums — currently ranging from $104.90 to $335.70 depending on income — so don’t sign up for Part B until you actually need it.

People still covered by employee health plans, for example, effectively get an extension. Ditto for people covered by a spouse’s employee benefits — except for same-sex spouses since the federal government doesn’t recognize those marriages. Once employer benefits end, people have eight months to enroll before triggering penalties.

The penalty for missing these Part B deadlines can be painful — a permanent premium increase of 10 percent for every 12 months missed. “Go five years without Part B, and you’ll have to pay a 50 percent penalty on your premiums when you do sign up,” said SHINE’s McDonough.

Too often people mistakenly believe that their retiree health benefits from a former employer will get them a Part B deadline extension. They don’t. Neither will COBRA coverage.

Part D, which provides prescription drug coverage, comes with its own set of deadlines and penalties. There’s no need to sign up if you have what’s called “creditable” coverage — a drug plan at least as good as what Medicare offers. If your plan doesn’t meet that standard — and your provider can tell you if it does — you need to sign up during the initial enrollment period when you turn 65. Once creditable drug coverage ends, however, you have only 60 days to sign up.

There’s a stiff premium penalty for missing these deadlines — a 1 percent increase for every month you’re late. That can add up fast. For example, someone who failed to sign up for Part D when it was first offered in 2006 would now face a penalty of over 80 percent.

Choosing the right drug coverage means not only looking at premiums, but also checking to see if your drugs are covered. The Medicare website can help match your prescriptions to available plans.

In Massachusetts, the state provides help through Prescription Advantage, an income-based program that helps with drug copayments. One example: Last summer, a woman needing a cancer drug costing $6,000 a month had hit her initial Medicare drug coverage limit but she was not yet eligible for catastrophic coverage. But since she qualified for the state program, her copay was $7.69, according to McDonough.

Plans offered by Blue Cross Blue Shield, Tufts, Harvard Pilgrim, and others provide an alternative to original Medicare. Known as Medicare Advantage, the plans combine Parts A, B, and usually D in an HMO-like package along with additional benefits that might include vision care and health club reimbursement.

Prices, out-of-pocket costs, and rules governing how you get service can vary considerably, so compare plan details. If you’re going to be in Florida six months of the year, however, Medicare Advantage plans won’t work since they only cover emergency and urgent care when you’re outside your plan area.

Finally, those who opt for original Medicare shouldn’t be without a supplemental policy to cover all the things that Medicare doesn’t, such as copayments and deductibles. Massachusetts residents have an advantage here. The state doesn’t let insurers screen for preexisting conditions for supplemental policies. Moreover, Massachusetts residents can sign up for supplemental policies at any time, thanks to continuous open enrollment.

The Medicare Race Is On

By Kelly Greene : WSJ : October 15, 2011

The 2012 plans feature significant changes, including new enrollment and coverage rules.

"We're seeing these plans getting increasingly complex, with more fine print about what they will pay," says Joshua Greenberg, president of HealthCPA in San Mateo, Calif., which offers fee-based Medicare counseling. "It could have huge financial implications."

For example, if you need the arthritis drug Celebrex and your Medicare plan doesn't cover it, you could be out of pocket $1,176 a year, Mr. Greenberg says. If it is covered, your out-of-pocket cost could be cut in half.

Navigating the process also can be onerous. "To find providers who will accept [Medicare], and to find the right supplemental plan and be confident about your coverage, is overwhelming," says John Cochran, 68 years old, a retired bank CEO who used HealthCPA to help change his Medicare coverage when he started spending more time in Florida than New York and Ohio last year.

Each year, Medicare users have to choose several parts of their coverage. If you use "traditional" Medicare—Parts A (mainly hospitalization), B (which covers doctor visits and other outpatient care) and D (a prescription-drug plan)—you have to select a specific drug-plan provider. Unless you get supplemental coverage through an employer, you also may want to buy a separate Medigap policy to help with uncovered costs.

Instead of paying for Parts B and D, you could sign up for a Medicare Advantage plan—known as Part C—which typically works like a managed-care plan with a set group of providers and may or may not also cover drugs. It also could include such extras as dental and vision coverage.

Even if you, or your parents, have been satisfied with Medicare this year, it is becoming more important to review that coverage because many moving parts could trip you up. Plans are even more in flux than normal due to the health-care-law changes in the past year, experts say. The Advantage plan you like might drop doctors or hospitals in its network, for example, or your Part D plan could alter the drugs it covers. (You can find details of your plan, such as the premium, co-payments and benefits, in your "Annual Notice of Change," which you should have received by Sept. 30.)

"It's like investing—you make investments, but you reallocate your portfolio periodically," Mr. Greenberg says.

There also might be other options with the same coverage at a lower price. Medicare Advantage premiums are expected to decrease by 4% on average next year from this year, and average drug-plan premiums are estimated to decrease about 2% to $30 a month, according to the federal Centers for Medicare and Medicaid Services, which manages the programs. Remember that these are averages; your plan could increase in price.

Also in 2012, Advantage plans won't be able to charge users for preventive services that are free to users of traditional Medicare, including annual wellness visits, as long as the providers are in the plan's network.

Another change: There is no time limit to switch into a five-star Advantage or prescription-drug plan. (See Medicare's Plan Finder tool at www.medicare.gov/find-a-plan.) Medicare users have one chance to switch to one of these top-rated plans at any point next year, a Medicare spokesman says.

To sort all this out, some Medicare users and their adult children are enlisting professional help. A few such services have a long track record, and others have started up in the past few years. HealthCPA charges $19.95 a month to help people choose Medicare coverage and manage payments throughout the year—plus $75 an hour to sort out "thorny" issues, Mr. Greenberg says. Allsup, a Belleville, Ill., firm that advises Medicare recipients and their families, charges $350 to assess all the Medicare options, which includes at least seven to 12 hours of analysis and working one-on-one.

If you change your mind about being in an Advantage plan after Dec. 7, you can "disenroll" between Jan. 1 and Feb. 14, as in past years, and return to traditional Medicare and add a Part D plan, or move into a top-rated Advantage plan. But there is a catch: If you go back to Parts B and D, you may not be able to buy Medigap at that point. The rules and consumer protections vary from state to state, and you may have to pay higher premiums or have some coverage excluded or delayed, according to the Medicare Rights Center, a New York advocacy group.

Free resources include the Medicare Rights Center (www.medicareinteractive.org) and your State Health Insurance Assistance Program, which offers independent counseling (www.medicare.gov/contacts). Be careful: If you seek help from an insurance broker, or through a service run by an insurance company, you probably won't get a review of every option open to you.

MEDICARE OPEN ENROLLMENT

By Deborah Kotz, Globe Staff October 14 14, 2011

“Open enrollment is seniors’ chance to review their Medicare choices and pick the plan that works for them, or keep the plan they have today,” said US Department of Health and Human Services Secretary Kathleen Sebelius in a statement issued last week.

The government’s health plan is available to all those age 65 and over and younger people with disabilities as well as those with kidney failure requiring dialysis or a transplant.

It’s definitely smart for Medicare enrollees to review their coverage during open enrollment because details can change from year to year, and they don’t want to get locked into a plan that will no longer work for them.

Last month, HHS announced that, on average, Medicare Advantage premiums will be 4 percent lower in 2012 than in 2011. Individuals, however, won’t know whether their own premiums will rise, fall, or remain the same until later this month.

If cost of living adjustments for Social Security benefits rise as expected, then Medicare part B premiums (which pay for check-ups and sick visits to the doctor, home health services, and some preventiv e health services) could rise too.

Those who enroll in Part B coverage for the first time this year are entitled to a free one-time, comprehensive “Welcome to Medicare” preventive visit -- to help reduce those expensive medical costs -- during the first 12 months of coverage that they have Part B.

If you’ve had Part B for longer than 12 months, you can get a yearly “wellness” visit to develop a plan to prevent disease based on your current health and risk factors. Those with diabetes, for example, could get a referral and coverage for a nutritionist to help them map out a meal plan.

About 1 percent of Medicare beneficiaries are enrolled in Advantage plans that won’t be available next year. These plans are offered by private insurers and operate like a health maintenance organization with provider networks for physician and hospital visits and drug coverage. Those with discontinued plans should have already received a notification by mail that they will need to find a new plan.

People enrolled in a discontinued Advantage plan will revert to a traditional Medicare plan -- with separate parts to cover outpatient and inpatient visits -- if they don’t choose another Advantage plan on their own. But they might find themselves out of luck when it comes to prescription drug coverage if they neglect to enroll in the separate Part D drug coverage plan.

Confused by all the choices? Well, consumers can now turn to a new “Medicare Plan Finder” that launched on October 1. It compares plan ratings -- with a new star rating system -- out-of-pocket costs, premiums, and drugs that are covered on various plans to help enrollees comparison shop and choose among Advantage plans or traditional Medicare. They can also call 1-800-MEDICARE for personal assistance to find out more about coverage options.